Engage with Confidence: Trust in a Public Adjuster for Your CT, NY & NJ Insurance Claims

The Insurance Claim Landscape and Its Challenges

The path to securing an insurance claim for property damage can be fraught with complications and hurdles. Disputes often arise when the insurance company’s adjuster, who is there to represent the insurer, disagrees with you on the extent of your property damage. These adjusters wield significant power in determining the settlement amount offered by the insurance company, and they’re trained to challenge claims made by policyholders like you.

It’s important to remember that the insurance adjuster works in the best interests of the insurance company, not yours. This often results in disagreements arising a few weeks into the claim process, at which point the adjuster typically adopts a more challenging stance to strengthen their negotiating position. However, you’re under no obligation to accept the initial settlement offers; in fact, standing your ground could eventually yield better results as insurance companies often prefer to compromise rather than prolong disputes.

As the policyholder, the onus of “proving” the extent of damages falls on you…

Navigating the Complexities of Your Insurance Policy

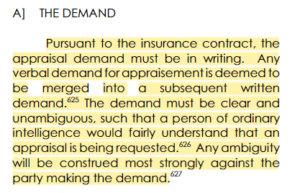

If you’re like most people, the first time you’ll delve into your insurance policy might be after sustaining a property loss. Insurance policies are, in essence, contracts filled with complicated terms, technical jargon, and legal provisions, which can be overwhelming. What’s more, as a prewritten document that you signed to obtain coverage, you had no input in its creation.

Many policyholders are surprised to learn that their policies contain specific duties and requirements they must adhere to. Even a minor failure to comply could lead to a complete claim denial or significant loss of coverage. The complex language and interpretation of these policies are often the root cause of claim denials, underpaid settlements, and protracted disputes.

But, there’s a solution. To help policyholders navigate these challenges, states across the US, including New York, Connecticut, and New Jersey, have mandated their State Insurance Departments to license professionals known as “Public Insurance Adjusters” to represent the rights of the public during property insurance claims.

Mastering Claim Negotiation, Damage Evaluation, and Proof

When it comes to partial losses, you might receive partial payments during the negotiation process. In these situations, it’s crucial to ensure that these do not represent full settlements. Documented proof, such as receipts, invoices, and estimates, is crucial to support your claim. It’s also advisable to work with independent experts or vendors who aren’t tied to the insurance company.

Your insurance policy is your “rule book.” It specifies your coverage and post-loss obligations. Understanding it empowers you to know when an adjuster’s demand is baseless and not required under your insurance policy.

A More Effective Alternative: Public Insurance Adjusters

An early intervention by a Public Insurance Adjuster can mitigate most of the potential pitfalls in the claims process. Unfortunately, due to a general lack of understanding about the claims process, many policyholders don’t realize they have the right to retain their own representation, much like the insurance company.

Public Insurance Adjusters are insurance claims adjusters who advocate for you, the policyholder, during the insurance claim process. They can represent your rights during a property insurance claim and help ensure you get a fair settlement.

Time Saving and Efficient Claim Handling

In addition to advocating for your financial interests, your Public Insurance Adjuster will handle the time-consuming tasks associated with documenting and supporting your claim. They’ll bring in the right experts, file necessary documents, and carry out other activities required by your insurance policy. This leaves you with more time to focus on personal matters and the reassurance that your claim is being managed professionally, with your best interests at heart.

The Right Time to Engage a Public Adjuster

While you can technically hire a Public Insurance Adjuster at any stage of the claim process, they’re generally more effective when brought in at the beginning. This allows them to help you receive a fair settlement for all losses covered under your insurance policy.

The benefits of a Public Adjuster can far outweigh their fee, usually about 10% of the settlement. They have the expertise to identify hidden damages, document expenses, and claim costs that insurance companies often overlook, and most property owners might not even know are covered.

Public Insurance Adjusters can help tremendously by taking control of the claim process, shielding you from endless documentation requests, estimates, and meetings. They also make claim settlements easier by conducting detailed inventories of property damage, consulting with industry experts, and explaining the entire process in understandable terms.

At Class Action Adjusters, Inc., we are committed to assisting you navigate the claims process smoothly and efficiently. Don’t navigate the confusing world of insurance claims alone. Let us be your advocates in ensuring you get the settlement you deserve. Contact us today.